Driving through a neighborhood in October, it isn’t uncommon to find houses adorned in larger-than-life skeletons, inflatable characters, animatronics and other items to get into the spooky spirit of the season.

Halloween decorations have increasingly grown in popularity over the years and it’s become a lucrative opportunity for retailers.

Nearly 70% of consumers plan on celebrating Halloween this year, sending projected spend on the category to $10.6 billion, up from $10.1 billion in 2021, according to a survey conducted by Prosper Insights & Analytics and the National Retail Federation. One of the most popular ways consumers plan to celebrate the holiday is through outdoor decorations, coming only second to candy, the survey found.

Similarly, a LendingTree survey released earlier this month found that 87% of consumers plan to spend on Halloween this year, a 16% increase from last year, with about 40% saying they’ll spend on outdoor decorations.

But Halloween wasn’t always a holiday where consumers shelled out a lot for decorations and other items.

So how did this holiday become a more than $10 billion business?

Early Halloween traditions in the US

The history of Halloween dates back centuries and became popular in North America following the arrival of Irish and Scottish immigrants to the US in the 19th century.

By the early 1900s, Halloween was a holiday geared toward adults hosting parties, according to Mark B. Ledenbach, a long-time collector of Halloween antiques and author of “Vintage Halloween Collectibles: An Identification and Price Guide.” At the parties, adults would play games like Bridge, Mahjong and Canasta and add decorations to their homes. The decorations, which featured scary imagery, were inexpensive and consumers would often throw them away after the parties ended.

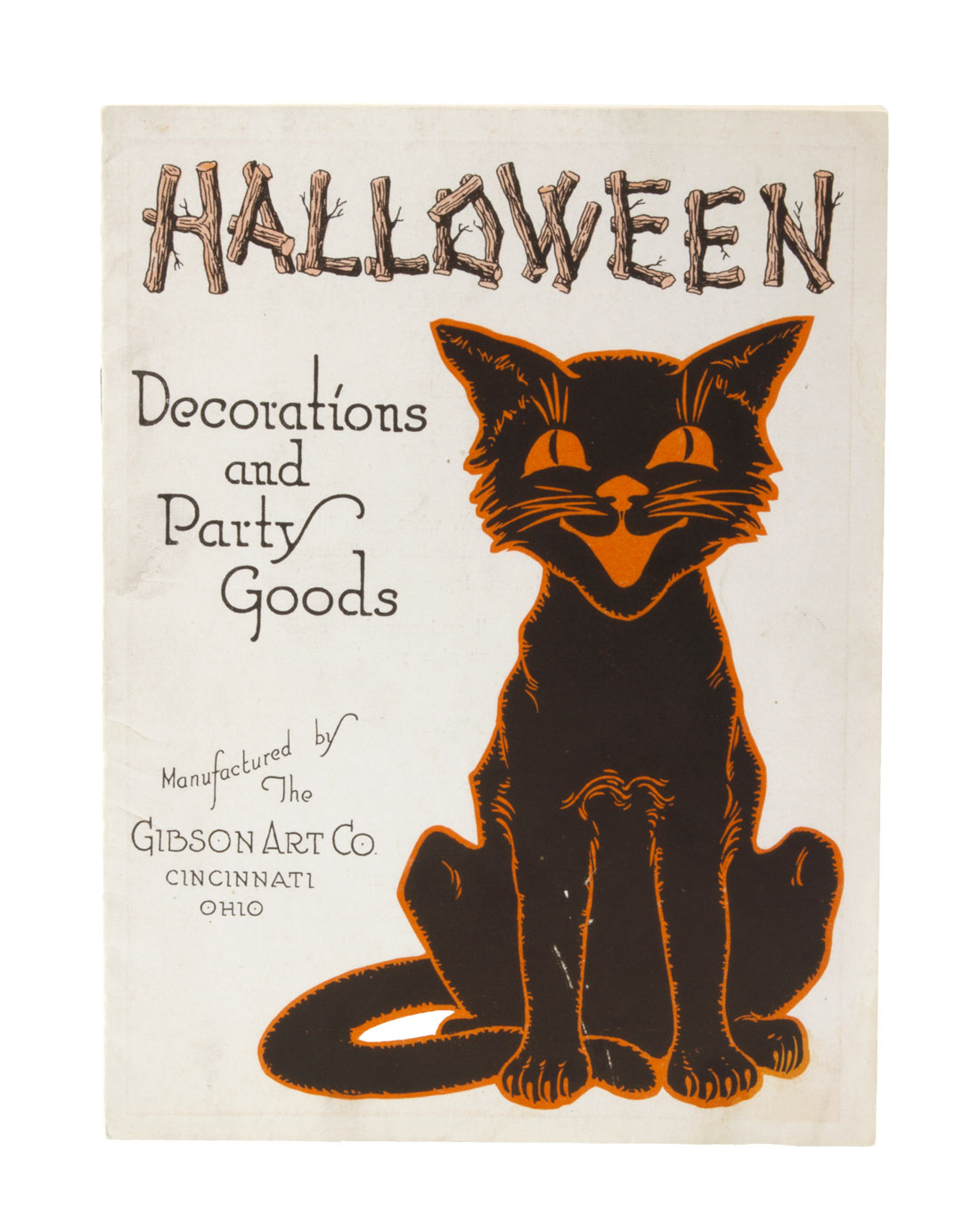

Permission granted by Mark B. Ledenbach

During this period, there were three major manufacturers of decorations: The Beistle Company, Dennison Manufacturing (which merged with Avery International in 1990) and Gibson (which was sold to American Greetings in 2000). Dennison, which was based in Framingham, Massachusetts, produced the “Bogie Book,” which described ways consumers could plan, prepare, and decorate for Halloween parties.

But as time progressed, the holiday began to move away from being a night for adults.

In the mid-’30s Halloween slowly started to change in the US and was accelerated even further after World War II ended. The holiday shifted from being adult-focused to being catered to kids, by parents hosting children’s Halloween parties and schools offering events around the day.

Permission granted by Mark B. Ledenbach

As a result, decorations began to change, depicting friendlier imagery versus scary. This shift was further propelled by pop culture with the introduction of “Wendy the Good Little Witch” and “Casper the Friendly Ghost” by Harvey Comics. And while some adults still hosted their own Halloween parties, the big three manufacturers directed their focus away from that consumer segment and to family-friendly imagery.

Decorating for the holiday slowly became more mainstream. In 1958, First Lady Mamie Eisenhower decorated the White House for Halloween for the first time, featuring skeletons, jack-o-lanterns, dried corn and pumpkins.

The White House Halloween decorations in 2013

Mark Wilson via Getty Images

Still, the widespread extravagant displays on the outside of homes were years away.

There was a period of time in the 1960s, ’70s and even ’80s “where it would be more unusual for homes to have any Halloween decorations,” Ledenbach said. “It wouldn’t be shocking, but it would be unusual.”

Over the years, outdoor decorations became more common and the imagery depicted changed as well. Driven by movies like “Halloween,” “Friday the 13th” and “A Nightmare on Elm Street,” Halloween products became much more violent and gory.

More recently, adoption of large outdoor displays for the occasion has only accelerated.

“Over the last five years there’s been a real resurgence in people across the United States decorating in some way the outside of their home for Halloween,” Ledenbach said, adding that there’s also been a growing interest in Halloween from adults, particularly younger adults.

This year, millennial consumers plan to spend $255 on Halloween, followed by Gen Z ($202), Gen X ($145) and baby boomers ($58), according to LendingTree.

But what’s driving the uptick in interest in the holiday?

‘The proliferation of big-box stores’

Helping to contribute to this rise in popularity for Halloween decorations among consumers are mass merchants and other big-box retailers stocking shelves with products.

“It goes back to the proliferation of big-box retail stores — the Bed Bath & Beyonds and the Home Depots and the Lowe’s and so on. As those chains grew in size and scale, the offering of seasonal merchandise — whether it was spring, summer, holidays as well as Halloween — continued to grow,” Michael Brown, a partner and Americas Retail Leader at Kearney, told Retail Dive.

These big-box retailers are continuing to stock shelves deep with seasonal items: This year Home Depot increased its overall Halloween and fall assortment to 861 products during September and October compared to 418 in the same period last year, according to data provided to Retail Dive from DataWeave, a retail data and pricing analytics firm. The firm also tracked Walmart carrying 3,335 fall and Halloween products and Target having 197 Halloween products.

The appeal for retailers in offering Halloween and fall products, and catering to increasing demand, is that it creates a bridge between the spring season — which historically has been a major selling period for home improvement retailers — to the holiday season late in the year. Seasonal products can serve as a traffic driver during an otherwise slower season before retail’s all-important holiday quarter.

Home Depot introduced a 12-foot skeleton in 2020.

Courtesy of Home Depot

Retailers have started to introduce Halloween and fall decorations as early as the summer in some cases in response to holiday sales kicking off earlier, with some calling Halloween as the unofficial kickoff to the holiday season.

“I think what you’ve seen in the last decade is fourth quarter promotions starting earlier and earlier and earlier,” Matt Katz, a managing partner at SSA & Company, told Retail Dive. “It gives the retail community more opportunity to market and promote Halloween as a festive holiday, and it’s moved from the candy aisle in the grocery store to home and more mainstream mall-based retail.”

“Halloween, fall — all that becomes part of this push to capitalize on consumers’ holiday spending.”

Matt Katz

Managing Partners, SSA & Company

Beyond the mass merchants, retailers like HomeGoods and At Home have added aisles of Halloween and fall items, and even players like CVS and Aldi have expanded their assortment to offer these seasonal products to a lesser extent.

“Channels have been bleeding for a long time. Book stores have become convenience stores. Convenience stores have become food stores. Department stores have entertainment locations and restaurants. Retail has always been on the quest for more share of shopper mind and shopper wallet,” Katz said. “Halloween, fall — all that becomes part of this push to capitalize on consumers’ holiday spending.”

Competition among neighbors to have the best Halloween displays has steadily increased interest and demand for the category.

“We wanted the world to see that our houses and our homes were welcoming and festive and that we were just generally fun people,” Kearney’s Brown said. “The more and more that there’s the availability of these products, it becomes almost competitive among homeowners in their neighborhood to see who can be the one that’s really demonstrating the holiday spirit.”

That sense of competition has been propelled further by the rise in social media, contributing to consumers not only buying more decorations for the occasion, but shelling out more for them.

In 2020, Home Depot introduced a 12-foot skeleton with LCD eyes for $299. The product became a viral hit for the retailer with it selling out of an early drop in August last year, and it racking up a price tag of up to $1,000 on resale sites like eBay. This year, the company increased its outdoor Halloween decorations by 104% year over year to 245, according to DataWeave. Home Depot brought back its 12-foot skeleton— which has again sold out — for the third time and introduced additional larger-than-life characters as well, including a 12-foot hovering witch for $299, 9.5-foot werewolf originally priced at $399 and a 15 foot phantom originally priced at $399.

In July, home improvement rival Lowe’s responded by introducing his own 12-foot mummy with light and sound effects for $348.

“I’m seeing more and more recently ‘the supersized,’ whether it’s blow-ups or the supersized statues in various different forms that continue to show up on people’s lawns,” Brown said, adding that “Retailers are using every holiday that they can to drive additional traffic to their stores, and in driving the additional traffic to the stores, they have to offer something that’s new and differentiated. The offerings that they’re bringing are getting very sophisticated, very big, very expensive, and consumers are attracted to what they see in the aisles. It’s impulse buying.”

But in the face of inflation and other economic pressures, consumers are starting to tighten their wallets and pull back on discretionary spending, potentially sending demand for excessive decorations down.

“This decor for this holiday — and all holidays really — is truly discretionary income,” Brown said, adding that demand and spending may have peaked for Halloween decor, at least for a couple of years. “People might just have enough to hold them through the recession and then maybe start spending again when incomes rise.”

During the 2008 recession, Katz recalls a more muted season in terms of the number of outdoor decorations people put on their homes. “Back in 2008, there was nervousness in October to over-decorate your home. You didn’t want to be the extravagant house on the block during that time, so people pulled back” he said. “Coming out of that recession, you saw tremendous pent-up demand from families, but also an acknowledgment that things have gotten better: ‘I feel better about my community and I’m going to participate in this way.’”

For this season, though, retailers have still stocked shelves full and deep discounting hasn’t begun yet, according to Brown, indicating demand is still strong.

As Halloween continues to grow more in the US and other parts of the world, Ledenbach sees it as a “phenomenon that will grow.”

“I don’t see this as a fad. I see this as a time that people can have some fun before the big holidays like Thanksgiving and Christmas and New Years, before they really start,” he added. “I always say that Halloween is the gateway to fun. The gateway to the holidays.”

Did you miss our previous article...

https://yogameditationdaily.com/yoga-business/meet-sebastian-brosche-developer-of-yoga-for-bjj